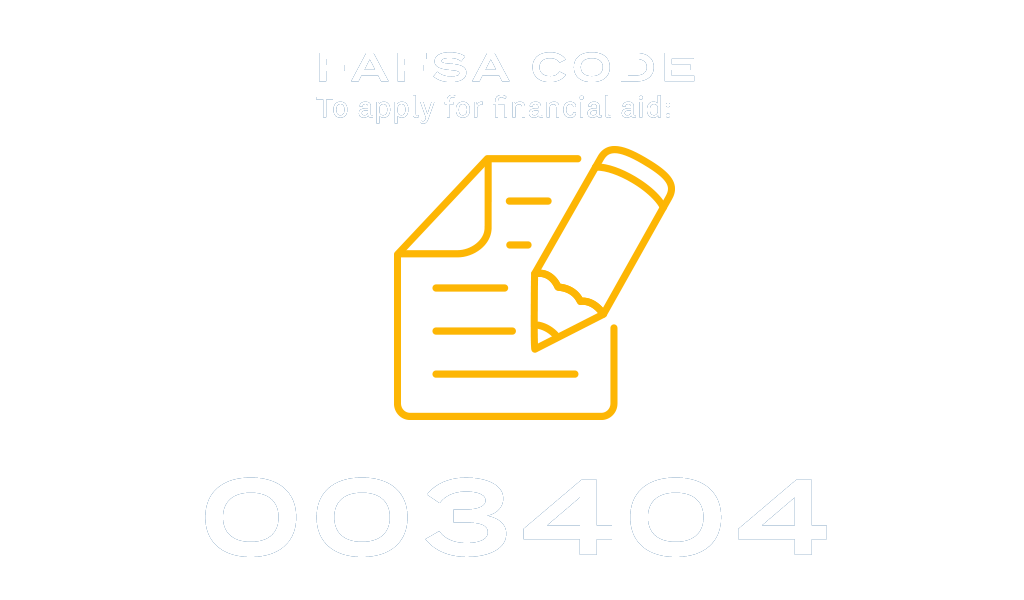

Financial Aid

Introducing the JWU Pledge

Furthering our commitment to affordability

Johnson & Wales University will make our high quality, hands-on education more accessible and affordable. This new initiative, named the JWU Pledge, covers up to 100% of tuition for eligible students and families with an annual household income of up to $80,000 and at least 70% of tuition for those with a household income below $200,000.

5 Ways to Finance College

A college education is becoming a requirement for many jobs worldwide — but it comes with a cost. Yet there are many more ways to afford a college degree than you might think, and JWU is here to help guide you through them! More than 98% of all JWU students receive institutional scholarships and/or grants from the university.

1

Scholarships and grants are both funds you may obtain for college that you don’t have to pay back. Scholarships, whether from JWU or from third parties, tend to be based on academic merit. Grants, including Pell grants and Federal Supplemental Education Opportunity grants, are based on financial need.

2

An annual report on how students pay for college shows that nearly half of the cost of college educations are funded by parent income and parent savings, while another 2% of the cost is funded by other family members. Talk with your relatives or guardians to explore how they can help you secure your future!

3

Your own savings are a great investment toward your future — so keep adding to that piggy bank and exploring scholarship and grant opportunities! Many students have a college savings plan — like a 529 account — to which they or their families have contributed funds toward their education, waiting for the day you get your acceptance letter!

4

You may obtain low-interest federal loans that can be repaid over a number of years. Loans can be subsidized (where the government pays the interest for you as long as you’re enrolled at least half-time in college) or unsubsidized (where you’re responsible for all interest). You may also obtain private loans from lenders such as banks and credit unions.

5

Federal Work-Study provides part-time jobs for students with financial need, allowing them to earn money to help pay education expenses, while part-time student employment opportunities abound to help JWU students earn money. JWU offers a variety of student employment opportunities, such as student assistants and student teachers, to JWU students from all economic backgrounds.